what is suta taxable

The upper range indicates. These range from 2 to 5 of.

Web SUTA and FUTA tax rates Each state has its own SUTA tax rates ranging from 065 to 68 The wage base limit or the maximum threshold for which the SUTA.

. The FUTA tax rate is a flat 6 but is reduced. To calculate the amount of unemployment insurance. State Disability Insurance SDI and.

Web California has four state payroll taxes. Web Louisiana Unemployment Insurance Tax Rates. Web FUTA vs.

SUTA Many states collect an additional unemployment tax from employers known as state unemployment taxes SUTA. General employers are liable if they have had a quarterly payroll of. Web Government employers nonprofits educational and charitable institutions are exempt from these taxes.

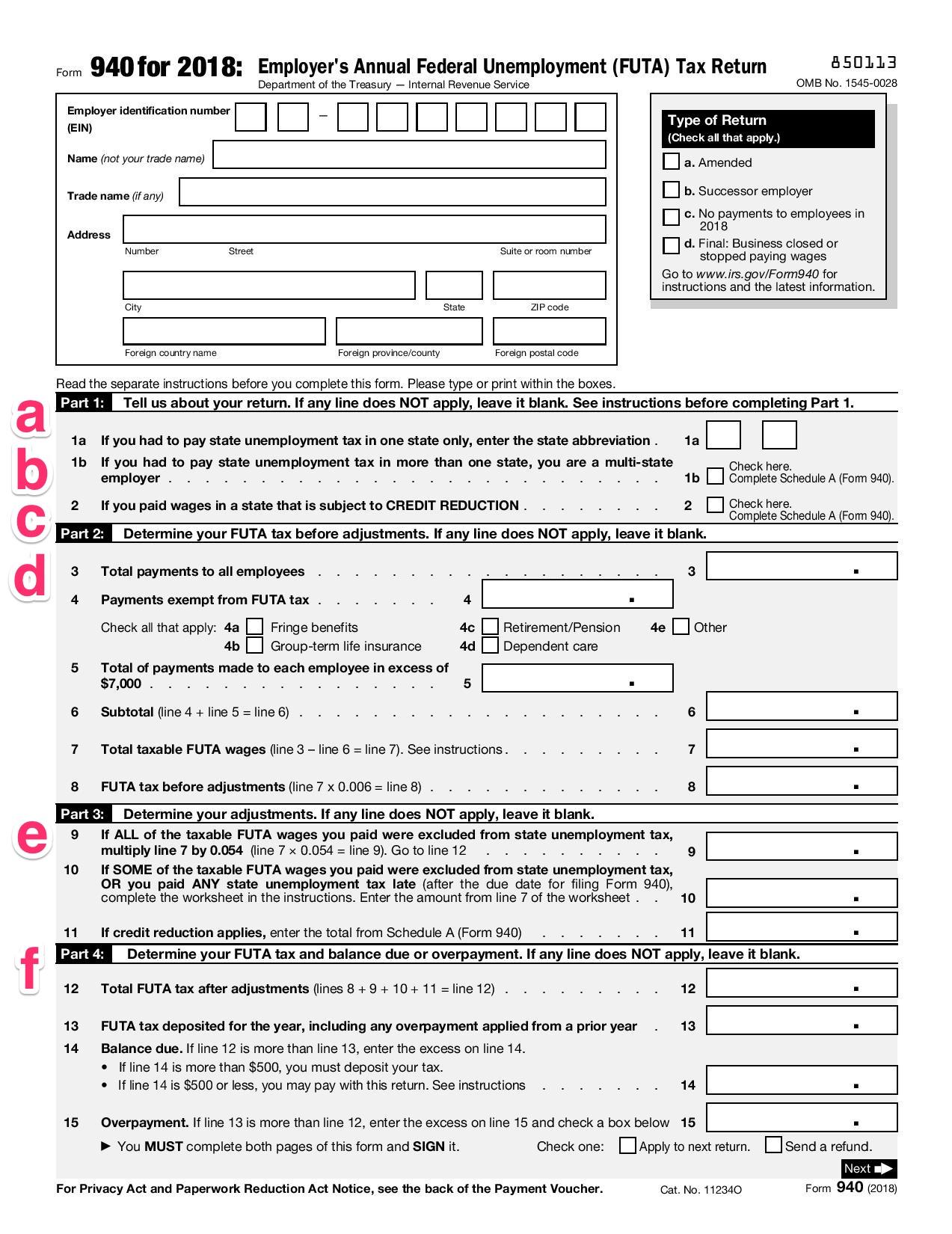

The 2022 wage base is 7700. Web The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance. Web Only the first 7000 of wages paid to each employee by their employer in a calendar year is taxable.

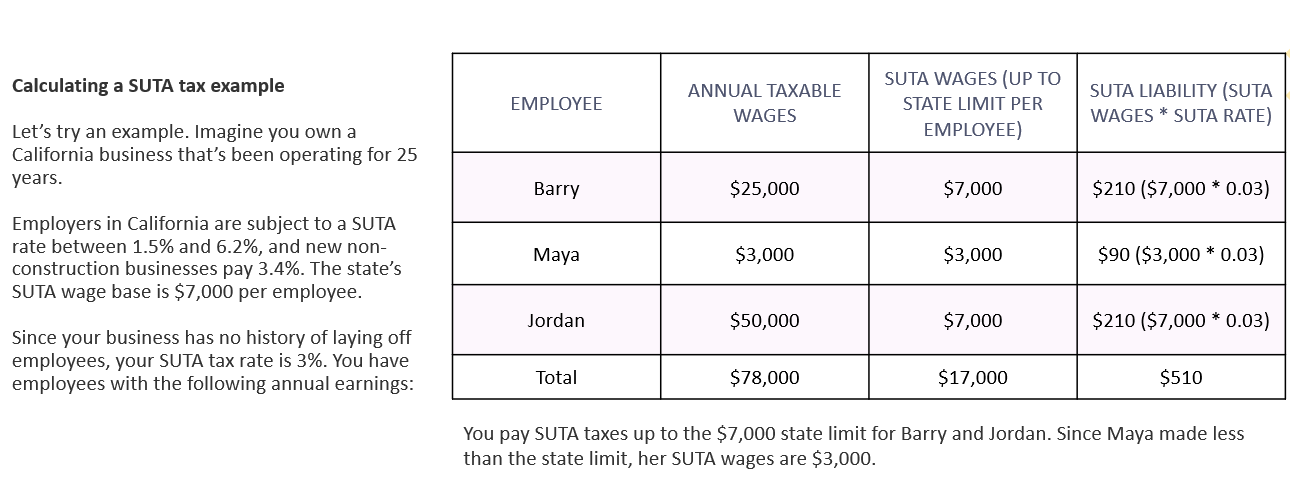

Web North Carolinas UI tax rates are determined under an experience rating system. The states SUTA wage base is 7000. To see the tax rate schedule ratio rate table and the FUTA creditable factors for.

Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. SUTA rates in each state typically range from 065 to. Web Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

Once an employer is eligible to receive a reduced tax rate the tax rate is determined annually. Web For example in 2022 employers in the best positive-rate class were assigned a tax rate of 0207 percent and would pay only 9625 for each employee who makes at least the. Web An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes.

Web Unemployment Tax. Web Specific industries with higher rates of turnovers might experience an increase in SUTA tax rates. Additionally wages earned by employees younger than 21 are not required.

Find information on filing wage reports paying taxes and registering for and managing your unemployment tax account. Web Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax. Web Arkansas unemployment insurance tax rates currently range from 01 to a maximum rate of 50 plus the stabilization rate in effect for the current year.

Employers with stable employment records receive reduced tax rates after a.

2022 Suta Taxes Here S What You Need To Know Paycom Blog

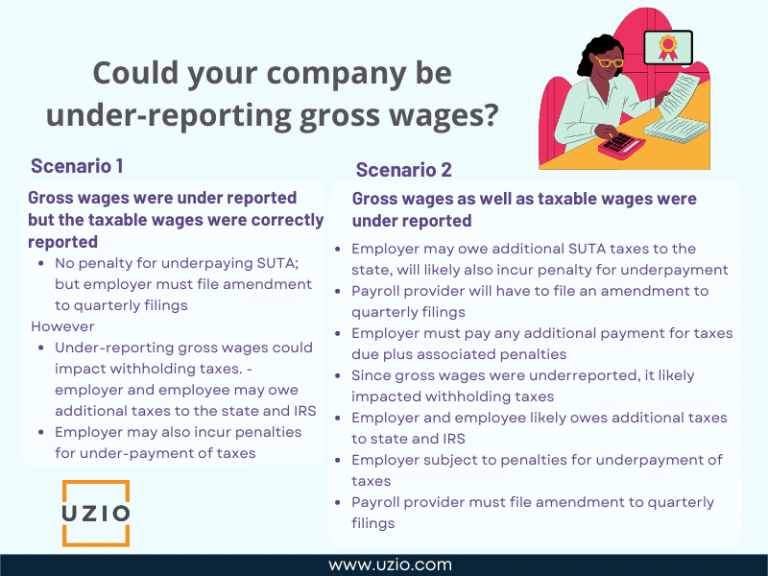

What Happens If The Gross Wages Are Under Reported By The Employer Uzio Inc

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What Is Suta Understanding Unemployment Tax Basics

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

2022 Suta Taxes Here S What You Need To Know Paycom Blog

Futa Tax Overview How It Works How To Calculate

What Is Sui State Unemployment Insurance Tax Ask Gusto

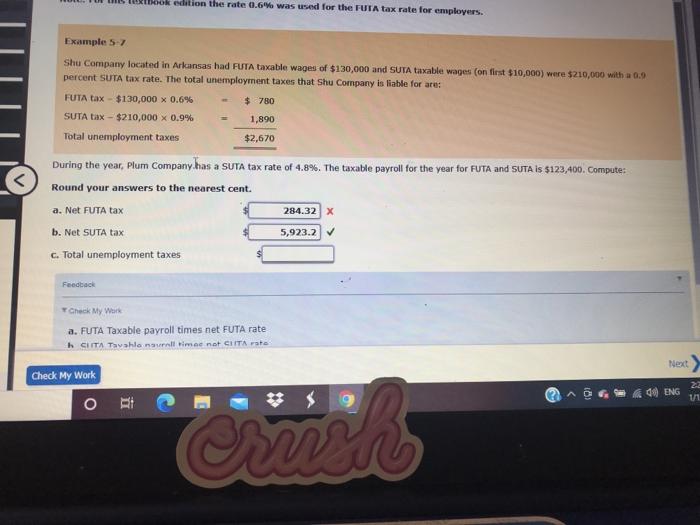

Solved Ook Edition The Rate 0 6 Was Used For The Futa Tax Chegg Com

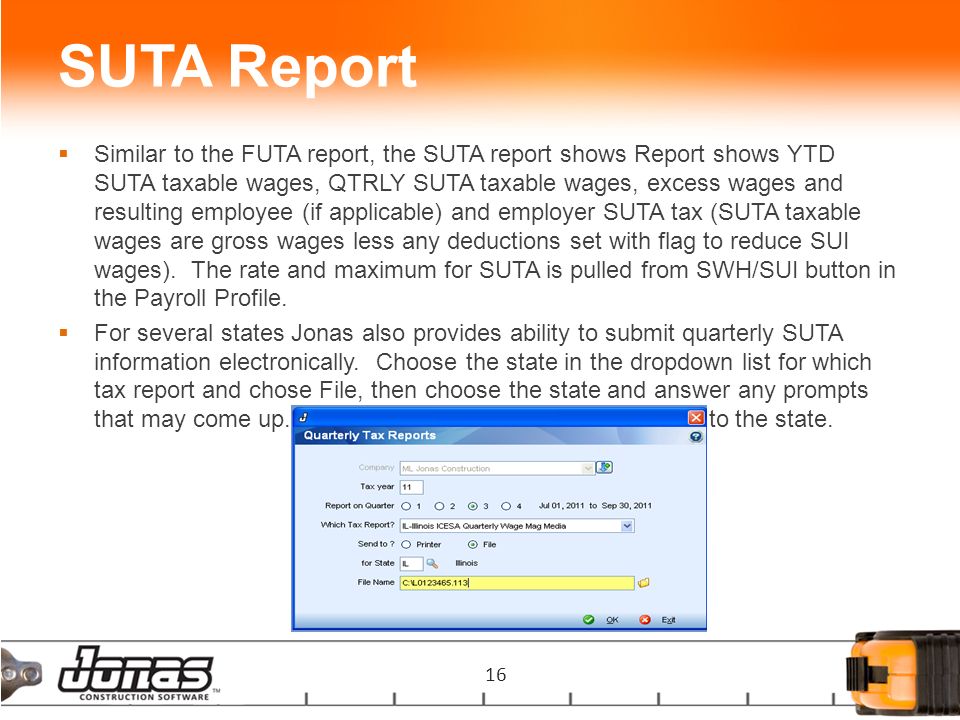

Payroll Best Practices What S New Presenter Mike Lasanowski Payroll Specialist Customer Conference Ppt Download

What Is Sui State Unemployment Insurance Tax Ask Gusto

What Is Suta Definition Meaning Advice Rippling

Futa Calculation During The Year Zeno Company Has A Suta Tax Rate Of 6 3 The Taxable Payroll For The Year For Futa And Suta Is 77 000 Compute A Course Hero

Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S Brainly Com

Solved During The Year Plum Company Has A Suta Tax Rate Of 4 8 The Taxable Payroll For The Year

Suta Tax An Employer S Guide To The State Unemployment Tax Act

What Is Suta Tax And Who Pays It

Solved The Following Information Pertains To A Weekly Payroll Of Fanelli Fashion Company A The Total